|

23 October 2023 last updated |

|

| Annuity rates reduce as gilt yields reach a record 5.13pc high |

|

| |

Gilt yields rise 45 basis points to a sixteen year record high 5.13% but annuity rates are lower. |

|

|

|

|

|

Annuity rates are reducing even though gilt yields have reached a record high of 5.13% as central banks expect interest rates to remain higher for longer.

Pension annuity rates have reduced with our benchmark example for a 60 year old using £100,000 to purchase a single life and 3% escalating income lower by -2.7%.

In contrast, the

15-year gilt yields have been volatile falling to 4.68% on 11 October before rising 45 basis points to a sixteen year record high of 5.13%. This exceeds the high of 5.09% attained after the mini budget in September 2022.

Find related news here:

Gilt yields rise to 4.8pc as interest rates to remain higher for longer

Annuities rise 1.5pc with record yields expecting higher interest rates

Inflation in the US remains higher at 3.7% in September 2023 compared to the 2% target and inflation in the UK remains resilient at 6.7%.

The central banks did not increase interest rates at the last meeting although they have stated an expectation of interest rates remaining higher for longer.

|

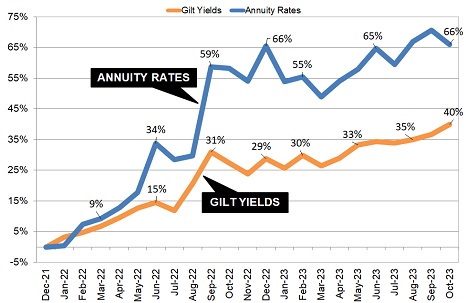

| Fig 1: Chart comparing annuity rates and 15-year gilt yields |

The above chart shows annuities remain at a fourteen year high although our benchmark example for a 60 year old using £100,000 to purchase a single life and 3% escalating income has seen the annuity rate reduce this month.

For our benchmark example annuity income increased to £4,638 pa in September 2023 up 70.5% since the low point in December 2021. For the month of October annuity income has decreased slightly to £4,512 pa and is now up 66.0% since December 2021.

In terms of the annuity income with largest percentage rise, the biggest is for the youngest people taking benefits aged 55 years old with a fund of £100,000 based on 50% joint life annuity with 3% escalation and income up +91% or £1,812 pa since December 2021.

The largest monetary gain with a fund of £100,000 is for those aged 74 years based on single life and level income with percentage rise of +41% and monetary amount of £2,818 pa.

In contrast the 15-year gilt yields have increased consistently and are up 399 basis points or 40.0% from 1.14% in december 2021 to 5.13% on 23 October 2023.

If interest rates from central banks do not increase further then gilt yields will remain at or near current levels for the remainder of the year.

Annuity rates may have reduced in October as providers have administrative difficulties due to the higher volumes, reducing their rates to lower the number of applications. This problem may continue limiting providers to increase rates in the future.

|

|

|

|

|

|

|

| |

Age |

Single |

Joint |

|

|

| |

55 |

£6,654 |

£6,281 |

|

|

| |

60 |

£7,014 |

£6,666 |

|

|

| |

65 |

£7,652 |

£7,219 |

|

|

| |

70 |

£8,619 |

£7,918 |

|

|

£100,000 purchase, level rates, standard

Unisex rates and joint life basis |

|

|

|

|

|

| |

Plan your annuity and get quotes from the 12 leading providers |

|

| |

| |

|

Free Annuity Quotes |

| |

|

No Obligation |

| |

|

From All Providers |

|

|

|

|

|

|

|

|

|

| You can follow the latest annuity updates on Twitter or as a fan on Facebook |

|

| |

|

|

|

|

|