|

30 August 2022 last updated |

|

| Retirement income at record high as gilts and pension annuities soar |

|

| |

Retirement income is 71.6% higher stable FTSE-100 index and the highest annuity rates for 11 years. |

|

|

|

|

|

Retirement income increased 71.6% to a record level as gilt yields and annuity rates are driven higher by inflation and higher base rates from the Bank of England.

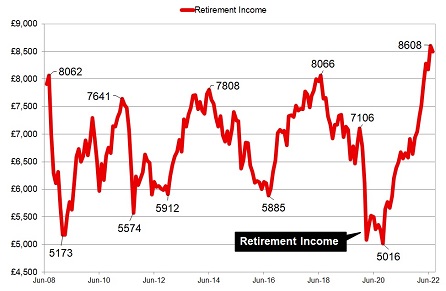

Our benchmark example shows the buying power of a pension fund has increased to £8,608 pa in July 2022 up 71.6% or £3,592 pa from the low of £5,016 pa in October 2020, when Europe entered the winter lockdown of 2020 during the pandemic.

The figures for our benchmark example are based on a 65 year old in good health buying a lifetime

annuity with £100,000 on a single life and level basis. It shows the buying power over time compared to the start date of June 2008.

The UK equity markets based on the FTSE-100 index remains at a high and steady level while annuity rates have increased to an eleven year high. Gilt yields have reach an eight year high of 3.08% on 30 August 2022 anticipating central banks including the Bank of England will raise base rates.

Find related news here:

Pension annuities fall as recession fears send gilts 27 basis points lower

Annuity rates rise by record 7pc last month as gilt yields weaken

This chart shows how retirement income has changed over time starting in June 2008 when the annuity income was 7,908 pa with a fund of £100,000. It assumes a portfolio tracks the FTSE-100 index and shows the buying power of the fund over time. With rises and falls in fund value and annuity rates, this is the income that could be generated.

|

| |

Benchmark annuity rates and FTSE-100 index |

|

| |

Feb |

Mar |

Apr |

May |

Jun |

Jul |

Aug |

| FTSE |

7,454 |

7,481 |

7,544 |

7,607 |

7,172 |

7,413 |

7,361 |

| Rate |

£5,322 |

£5,440 |

£5,691 |

£5,893 |

£6,169 |

£6,283 |

£6,243 |

|

Fig 1: Chart and table comparing retirement income from 2008 to 2022 |

The buying power of £100,000 has changed over time starting in June 2008 at £7,908 pa and rising the next month to £8,062 pa. With rising and falling equities and gilt yields, the buying power of this fund was not exceeded until a decade later in July 2018 with £8,066 pa.

It has taken until May 2022 to breach this level again with £8,285 pa and a high in July 2022 of £8,608 pa. Although the buying power of the retirement income does not keep up with the cost of living, annuity rates increase with age.

For our benchmark example of a 65 year old in 2008, they would be aged 74 now, and by delaying an annuity purchase the fund value over the last 14 years is larger at £137,000. Annuity rates are also higher at 8.1% producing an income of £11,097 pa. This represents a compound rise of 2.44% per annum which can off-set some of the rise in cost of living over this period.

The combination of supply chain problems recovering from the pandemic and rising energy costs due to the Russian-Ukraine war has resulted in higher inflation. The 15-year gilt yields started the year at 1.14% and due to central banks raising base rates this has increase 182 basis points to 2.96%.

For our benchmark example of a 65 year old in good health buying a lifetime

annuity with £100,000 on a single life and level basis, annuity rates have increased since the start of the year by 22.7% or £1,158 pa from £5,085 pa to £6,243 pa.

Annuity rates will remain at current levels or higher while institutional investors are selling Treasury notes, gilts and bunds. This is due to the Federal Reserve stating their hawkish approach to raising base rates will continue until inflation in the US reduces further.

|

|

|

|

|

|

|

| |

Age |

Single |

Joint |

|

|

| |

55 |

£6,654 |

£6,281 |

|

|

| |

60 |

£7,014 |

£6,666 |

|

|

| |

65 |

£7,652 |

£7,219 |

|

|

| |

70 |

£8,619 |

£7,918 |

|

|

£100,000 purchase, level rates, standard

Unisex rates and joint life basis |

|

|

|

|

|

| |

Plan your annuity and get quotes from the 12 leading providers |

|

| |

| |

|

Free Annuity Quotes |

| |

|

No Obligation |

| |

|

From All Providers |

|

|

|

|

|

|

|

|

|

| You can follow the latest annuity updates on Twitter or as a fan on Facebook |

|

| |

|

|

|

|

|