|

25 April 2024 last updated |

|

| Gilt yields at record high after strong US data and dashed rate cut hopes |

|

| |

Gilt yields rise +40 basis points to a record high of 4.68% as early rate cut hopes are dashed. |

|

|

|

|

|

Gilt yields hit record high this year of 4.68% after strong economic data from the US means the hope of an early interest rate cut are dashed and possible rise for annuity rates.

The 15-year gilt yields rise +40 basis points to 4.68% as investors do not see the Federal Reserve cutting interest rates until later in the year.

If gilt yields remain at this level standard annuity rates could increase by as much as +5.6% in the short term although providers are currently slow to improve income.

In April strong US non-farm payrolls or employment figures increased by 303,000 when economists forecast 200,000 and US retail sales remained high increasing by 0.5% when 0.3% was forecast.

The US consumer price index (CPI) increased from 3.2% to 3.5% when economists were expecting 3.4% indicating inflation needs more time to reduce to the 2% target.

Find related news here:

Annuity rates can recover 3pc as strong US economy send yields higher

Pension annuities fall 3pc with lower yields and talk of interest rate cuts

Analysts had forecast the first of four US interest rate cuts to start as early as May this year, however, economic data in April means only one or two cuts are likely in the last quarter.

|

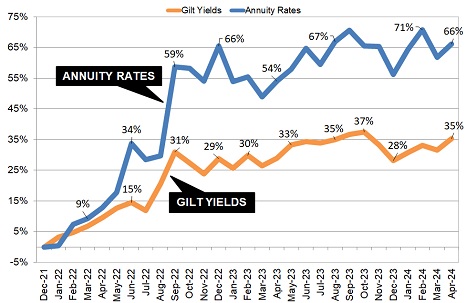

| Fig 1: Chart comparing annuity rates and 15-year gilt yields |

The above chart shows our benchmark example for a 60 year old using £100,000 to purchase a single life and 3% escalating income is currently at £4,515 pa and this income is 66% higher than the recent low in December 2021. This reached a peak income of £4,641 pa in February 2024 and has since reduced by -£126 pa or -2.7%.

Equity markets reacted negatively by 16 April with the FTSE-100 index lower by -2.0%, the Euro Stoxx 50 down -3.0%, the S&P 500 lower by -3.6% since the highs reached last month. This could reduced the value of pension funds that remain invested resulting in a lower annuity income.

In the UK, inflation is lower with RPI reducing from 3.4% to 3.2% and the level of unemployment increased from 4.0% to 4.2%. The Bank of England could consider reducing interest rates if inflation falls further and economic growth is slow.

The latest economic date shows there is a policy divergence

with the US delaying interest rate cuts until the fourth quarter with the EU planning to make the first cut in their 6 June meeting and UK in their 1 August meeting.

If this is the case, annuity rates could start to fall in the summer ahead of the meeting for the first cut in interest rates. This gives those retiring a period of time to secure guaranteed annuity income while annuities are still at a fourteen year high.

|

|

|

|

|

|

|

| |

Age |

Single |

Joint |

|

|

| |

55 |

£6,654 |

£6,281 |

|

|

| |

60 |

£7,014 |

£6,666 |

|

|

| |

65 |

£7,652 |

£7,219 |

|

|

| |

70 |

£8,619 |

£7,918 |

|

|

£100,000 purchase, level rates, standard

Unisex rates and joint life basis |

|

|

|

|

|

| |

Plan your annuity and get quotes from the 12 leading providers |

|

| |

| |

|

Free Annuity Quotes |

| |

|

No Obligation |

| |

|

From All Providers |

|

|

|

|

|

|

|

|

|

| You can follow the latest annuity updates on Twitter or as a fan on Facebook |

|

| |

|

|

|

|

|