|

| 19 May 2014 last updated |

|

| Enhanced annuities fall as Bank of England resist interest rate rise |

|

Enhanced annuities have reduced by up to 1.3% after Governor of the Bank of England Mark Carney has stated interest rates will not increase this year with gilt yields 17 basis points lower.

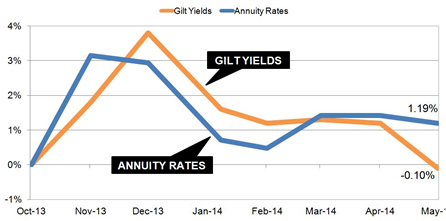

Annuity rates are based on the 15-year gilt yields which were at 3.20% and as a general rule a 17 basis point fall in yields will result in a 1.7% decrease in annuity rates.

Enhanced annuity providers such as Liverpool Victoria, Partnership and Just Retirement have already reduce their annuity rates to reflect the

lower margins in the market by as much as 1.3%. In contrast providers of standard annuities are slower to react.

There has been speculation from city analysts that interest rates would increase to as high as 1.75% by the end of 2015 including a rise this year.

The

Bank of England's Mark Carney has stated interests rates will be kept at 0.5% for some considerable time until the UK economy can become for established. |

|

|

| |

Bank of England states interest rates will not rise this year sending enhanced annuities lower |

|

|

|

| |

|

Yields threaten lower annuity rates

Providers of impaired annuities adjust their margins on a daily basis which can lead to falls in the rates offered. These margins have been reduced sufficiently to reduce the income offered but further falls are possible if yields reduce.

The following chart shows how yields and rates have changed since October 2013.

|

| Fig 1: Chart comparing annuity rates and 15-year gilt yields |

The sudden fall in yields in the last few days has resulted with a gap where annuities could reduce by 1.29%.

As an example for a person aged 65 with a fund of £100,000 could purchase a single life, level annuity with an income of £6,080 pa and this would fall to £78 pa to £6,002 pa with a fall of 1.29%.

In terms of lifetime income, the Office of National Statistics (ONS) would expect a male to live for 17.3 years and he will have £1,349 less over his lifetime. For a female she can expected to live for 20.4 years decreasing her income by £1,591.

Market expect interest rates to rise

Even though the Bank of England does not expect any change there is still an expectation of interest rates rise in the first quarter of 2015. In particular the housing market continues to see inflated house prices in London although monetary policy would be the last measure the Bank of England would consider.

It is likely that a sustained rise in house prices will result with increased wealth and greater consumer spending with the knock-on effect of inflation and higher interest rates.

For people considering buying annuities now it is likely rates will remain at current levels for the rest of the year. With improving interest rates in 2015 there is a strong probability annuity rates will rise but not for one or two years.

It would be possible to consider a fixed term annuity for one year allowing time to benefit from rising rates. This would provide you an income and a guaranteed maturity amount at the end of the term. The fund could be used to buy a lifetime annuity at that time from any provider in the market.

|

|

|

|

|

|

|

|

| |

Age |

Single |

Joint |

|

|

| |

55 |

£6,654 |

£6,281 |

|

|

| |

60 |

£7,014 |

£6,666 |

|

|

| |

65 |

£7,652 |

£7,219 |

|

|

| |

70 |

£8,619 |

£7,918 |

|

|

£100,000 purchase, level rates, standard

Unisex rates and joint life basis |

|

|

|

|

|

| |

Plan your annuity and get quotes from the 12 leading providers |

|

| |

| |

|

Free Annuity Quotes |

| |

|

No Obligation |

| |

|

From All Providers |

|

|

|

|

|

|

|

|

|

| You can follow the latest annuity updates on Twitter or as a fan on Facebook |

|

| |

|

|

|

|

|