|

5 March 2019 last updated |

|

| UK annuities could rise as investors leave safe havens |

|

| |

Increase in yields as investors leave safe havens could see annuity rates rise 1.8% |

|

|

|

|

|

UK annuities decreased in February by about -1% across the board while gilt yields increased 18 basis points as investors leave the safe havens such as gilts and bonds.

Providers base annuity rates primarily on the 15-year gilt yields which increased by 18 basis points to 1.61% and we would expect incomes to rise by about 1.8% over time.

| |

Annuity rates and gilt yields |

|

| |

Aug |

Sep |

Oct |

Nov |

Dec |

Jan |

Feb |

| Rate |

£5,563 |

£5,520 |

£5,558 |

£5,563 |

£5,570 |

£5,571 |

£5,487 |

| Yield |

1.57% |

1.71% |

1.62% |

1.63% |

1.50% |

1.43% |

1.61% |

|

The above table shows that for our benchmark example of a 65 year old with £100,000 an annuity on a single life, level basis would provide an income of £5,487 pa, reducing 1.5% in February.

In contrast gilt yields have increased 1.8% over the same period and a recovery in annuity rates is possible if yields remain at this level or rise further.

|

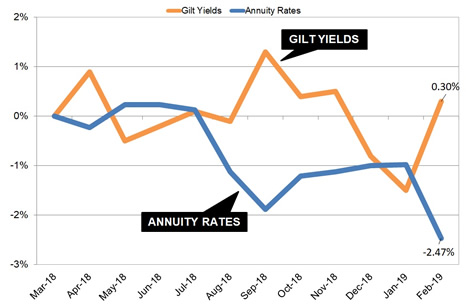

| Fig 1: Chart comparing standard annuity rates and 15-year gilt yields |

Over the year 15-year gilt yields have increased slightly by 3 basis points whereas annuities are lower by -2.47% suggesting an upward correction of 2.77% may be possible in the long term.

Annuities reached a recent high in the first half of last year and providers have maintained annuity rates at consistent levels until January 2019 and perhaps the uncertainty of how Brexit concludes has resulted in the recent fall in incomes.

Investors have been leaving the safety of gilts and bonds for other investments such as equities as the US and China are closer to a trade deal avoiding the planned rise in tariffs from 10% to 25% on $200 billion of Chinese goods.

Wall Street is less concern of an economic slowdown with positive growth and fall in jobless rate for the US with no immediate signs of recession. Fear over the Chinese economy may have been exaggerated and a US-China trade agreement may boost global activity and equity markets.

The current fall in annuity rates may be specific to Brexit and April could see a recovery if a deal can be agreed for the UK leaving the European Union.

|

| |

|

|

|

|

|

|

|

| |

Age |

Single |

Joint |

|

|

| |

55 |

£6,654 |

£6,281 |

|

|

| |

60 |

£7,014 |

£6,666 |

|

|

| |

65 |

£7,652 |

£7,219 |

|

|

| |

70 |

£8,619 |

£7,918 |

|

|

£100,000 purchase, level rates, standard

Unisex rates and joint life basis |

|

|

|

|

|

| |

Plan your annuity and get quotes from the 12 leading providers |

|

| |

| |

|

Free Annuity Quotes |

| |

|

No Obligation |

| |

|

From All Providers |

|

|

|

|

|

|

|

|

|

| You can follow the latest annuity updates on Twitter or as a fan on Facebook |

|

| |

|

|

|

|

|